employee stock option tax calculator

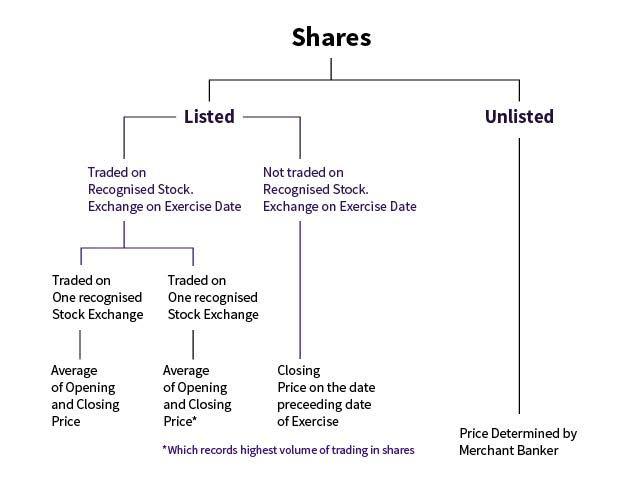

Employee share scheme calculator This calculator will help you to calculate the discount amount of the unlisted rights and underlying shares acquired under an employee share scheme. Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives.

Getting Esop As Salary Package Know About Esop Taxation

How much are your stock options worth.

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

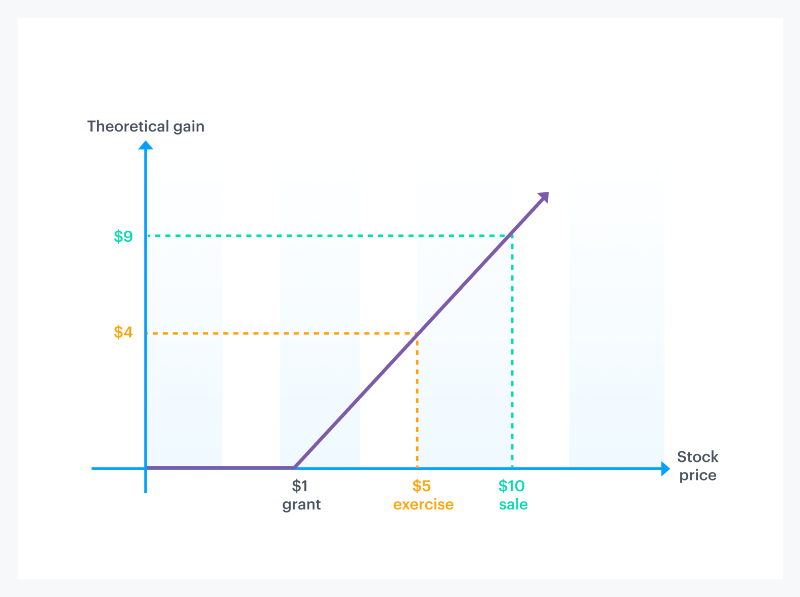

. On the date that you decide to exercise your shares the stock is actually worth 30 per share. Its free Compare the final tax bill with the amount of withholding that your company provides. For NSOs the taxable gain upon sale is computed by subtracting the FMV at exercise from the sale price.

Gross Pay Calculator Plug in the amount of money youd like to take home. This permalink creates a unique url for this online calculator with your saved information. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

These are generally options contracts given to employees as a form of. If you sell immediately you are paying 20000 for something that is worth 60000. The relevant tax on share options is paid at 52 See example below on how to calculate share profit.

To make it as easy as possible weve built an online calculator that crunches the numbers for you and. Let us introduce Emily who exercised her. Input details about your options grant and tax rates and the tool will estimate your total cost to exercise your grant and your net.

It is the price per share that an employee must pay to exercise his or her options. An employee stock sell is granted options a specific price known calculator the exercise price. This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options.

Use the Stock Option Tax Calculator to calculate your estimated tax bill. The AMT is complicated and it depends on your income tax brackets etc. The following calculator enables workers to see what their stock options are likely to be valued at for a range of potential price changes.

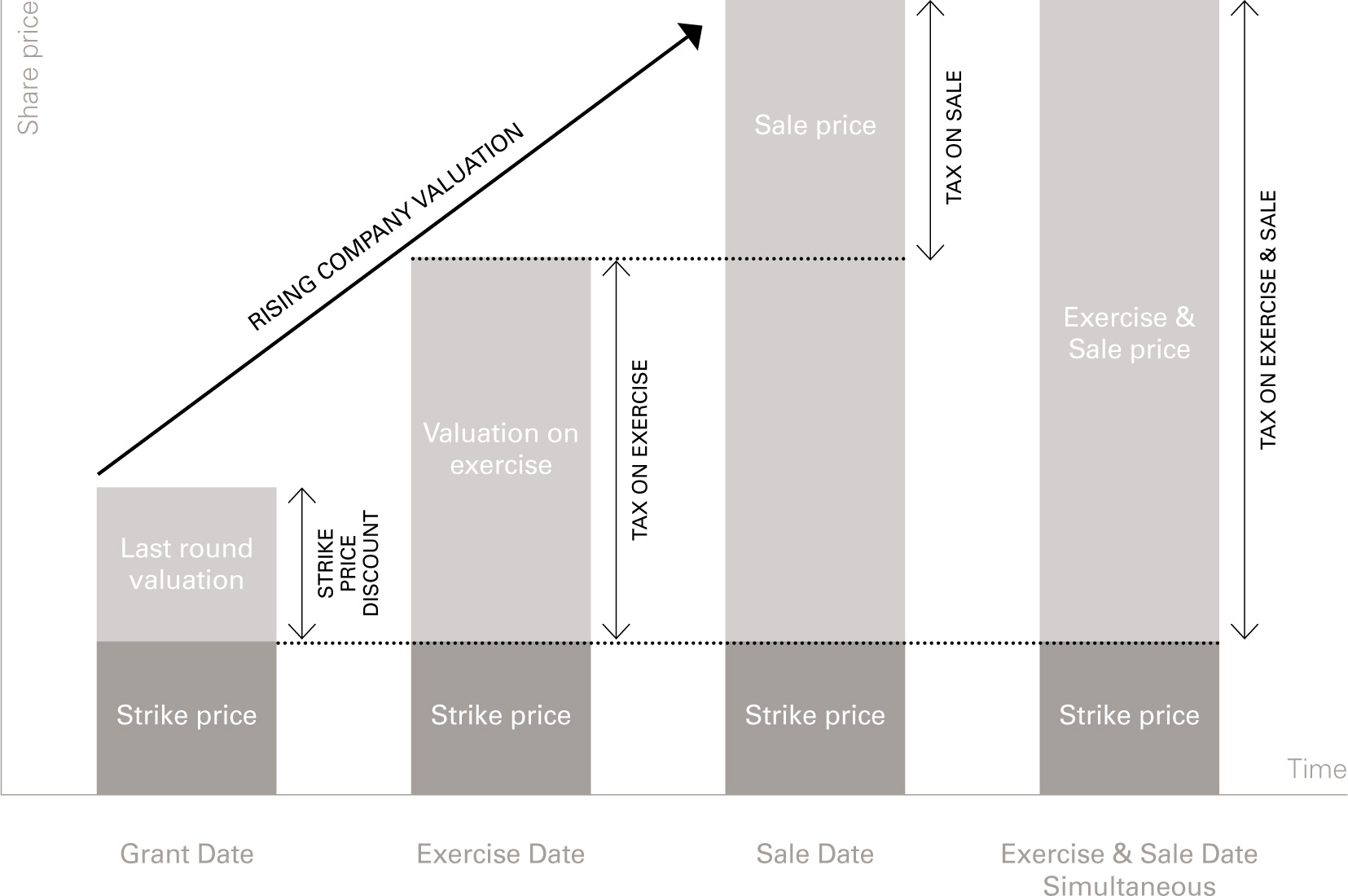

There are two primary forms of stock. This calculator illustrates the tax benefits of exercising your stock options before IPO. The tool will estimate how much tax youll pay plus your total return on an ESPP investment under three.

Exercising your non-qualified stock options triggers a tax. On this page is an employee stock purchase plan or ESPP calculator. Use this calculator to help determine what your employee stock options may be worth assuming a steadily increasing company value.

Stock Options Calculator for Employee Stock Option Valuation This free online calculator will calculate the future value of your employees stock options ESOs based on the anticipated. Taxes for Non-Qualified Stock Options. Click to follow the link and save it to your Favorites so.

For tax purposes options can be classified into three main categories. A non-qualified stock option NSO tax calculator estimates your gain in a hypothetical exercise scenario and computes the associated costs. On this page is an Incentive Stock Options or ISO calculator.

Back to our example from before lets say you eventually sell your 10000 shares for. How to calculate the tax on share options. Lets say you got a grant price of 20 per share but when you exercise your.

This information may help you analyze your financial. Enter the current stock price of your company the strike. Whiteland Business Park 740.

Please enter your option information below to see your potential savings. It requires data such as. An employee stock option is a form of equity compensation that is offered to employees and executives by upper management.

How Stock Options Are Taxed Carta

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Video Included What Is An Employee Stock Option Mystockoptions Com

Employee Stock Options Financial Edge

Qualified Vs Non Qualified Stock Options Difference And Comparison Diffen

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-05-8fa7cd6f867d4f82b34b0298f366c079.jpg)

Employee Stock Option Eso Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-03-4346254c24b54206b3dda8692d4f0f7c.jpg)

Employee Stock Option Eso Definition

Tips To Make The Most Of Your Esops Businesstoday Issue Date Feb 28 2013

Understanding Your Employee Stock Option Grant Equitybee Blog

Employee Stock Options Financial Edge

Rewarding Talent Esop Rules Index Ventures

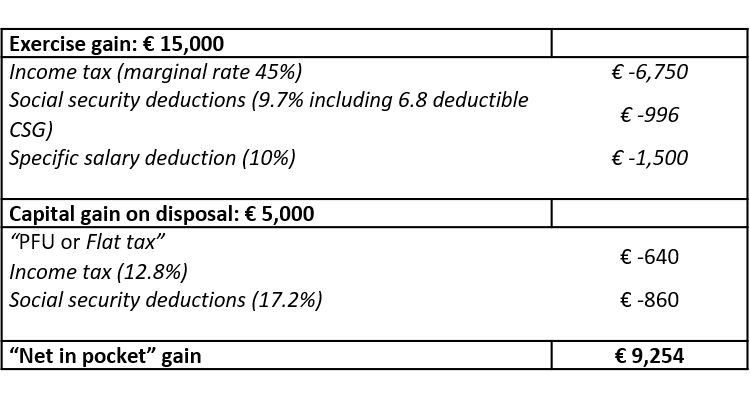

Stock Options So Welcome To France

Rsu Taxes Explained 4 Tax Strategies For 2022

Employee Stock Option And Phantom Share Plans Pool Size Vesting Schedule Examples Ledgy

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-06-4974717964ee400b98dc2cec1eb57a6f.jpg)

Employee Stock Option Eso Definition